12, تشرين ثاني, 2019

891

Apple owns every mistake Goldman Sachs makes with its card

Apple isn’t a bank, but its brand is tied to one now

One of the most important stories over the weekend was the news that Apple’s credit card is being investigated for discriminating against women. This story has almost as many layers as the apparently discriminatory algorithm Apple and Goldman Sachs use to determine credit limits.

But before I comment on any of this, I want to point you to the blog post by Jamie Heinemeier Hansson about the whole ordeal. She is the person who was denied the full measure of what her credit limit should have been because of Apple and Goldman Sachs’ black-box algorithm. You should read it in full, even though I’m about to quote a bit below, because it is important, level-headed, and blisteringly accurate. She lays out the stakes of this whole thing quite clearly:

It matters for the woman struggling to start a business in a world that still seems to think women can’t be as successful or creditworthy as men. It matters to the wife trying to get out of an abusive relationship. It matters to minorities harmed by institutional biases. It matters to so many. And so it matters to me.

This is the second time in as many months that Apple has found itself on the wrong side of a social justice issue. As it (at least initially) was with the app rejections in Hong Kong, the company has remained stubbornly silent on this issue so far.

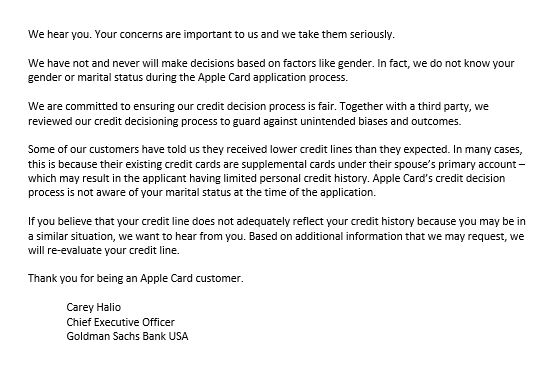

What we do have, however, is a couple of tweets from Goldman Sachs, which operates the banking side of the Apple Card. Neither is an apology, which you know both from the defensive nature of the statements and because they’re not hurriedly tweeted screencaps of the iPhone Notes app. Here’s the most recent one, as of last night:

Of course, you wouldn’t expect Goldman Sachs to apologize, because that could be used against it in the upcoming lawsuit. You also wouldn’t expect Goldman Sachs to apologize because it’s Goldman Effing Sachs, one of the architects of the housing crisis a decade ago that had to pay a $5 billion settlement and admit to a series of facts about how it misled investors.

You know, the company that Apple partnered with to launch the Apple Card.

Apple is trying to have all the benefits of a consumer and privacy-friendly credit card without any of the hassles that come along with it. Take a look at Apple’s promotional page for Apple Card: right now it’s led by the tagline “Created by Apple, not a bank.” I’m sure it was, in the same way that Apple’s products are “Designed in California” but assembled in China — though at least then Apple oversees the manufacturing and tries to guarantee a basic level of human rights.I know the line of rhetoric I’m pursuing here is a little overblown and somewhat unfair. What did I expect? Did I expect Apple to try to create a pure-as-the-driven-snow bank of its own to back its credit card? Even the mighty Apple has limits, and consumer financial services are definitely outside its bailiwick. And if it was going to partner with a big bank, there aren’t really any that are any cleaner than another. Goldman Sachs, at least, agreed to the privacy protections and less-fine-print Apple demanded.

And yet: the friction between Apple’s (justified!) image as a privacy-protecting company and Goldman Sachs’ less-than-stellar reputation comes up again and again. In light of the current debate, I took a look at Apple’s own support page that explains the policies behind credit approvals and limits.

The entire thing mirrors the first line: “Goldman Sachs uses your credit score, your credit report, and the income you report on your application when reviewing your Apple Card application.” In every sentence thereafter, Apple is distancing itself from any responsibility for the decisions Goldman Sachs is making in its name.

And that’s the heart of it: it’s not the Apple Card, it’s the Goldman Sachs card with an Apple interface and an Apple layer of privacy protections.

With almost every other product, Apple famously wants to control its entire supply chain, from the silicon to the software. It’s known as the Cook Doctrine, and Tim Cook laid it out stridently in an investor call a decade ago before he was CEO, when he was asked how Apple would operate without Steve Jobs running the day-to-day (emphasis mine):

We believe that we are on the face of the earth to make great products and that’s not changing. We are constantly focusing on innovating. We believe in the simple not the complex. We believe that we need to own and control the primary technologies behind the products that we make, and participate only in markets where we can make a significant contribution. We believe in saying no to thousands of projects, so that we can really focus on the few that are truly important and meaningful to us. We believe in deep collaboration and cross-pollination of our groups, which allow us to innovate in a way that others cannot. And frankly, we don’t settle for anything less than excellence in every group in the company, and we have the self-honesty to admit when we’re wrong and the courage to change. And I think regardless of who is in what job those values are so embedded in this company that Apple will do extremely well.

With the Apple Card, Apple does not own the “primary technologies” that power a credit card. It doesn’t have any control over whatever black-box algorithms Goldman Sachs is using, and has little to do with the actual operation of the credit and payment systems after that. It’s Goldman Sachs.

Apple has no control, but nevertheless Apple shares the responsibility. Not just because it’s Apple’s name on the card, but because Apple chose to make this thing in the first place.

Apple didn’t need to make a credit card. The fact that it did speaks to the company’s desire to diversify its revenue as part of the omnipresent shift to services. And as Nilay Patel has asked over and over again: “Will Apple compromise the user experience of the iPhone to upsell its own services?”

I’ve long said that this services push is a threat to Apple’s reputation. Except for people who are trying to MinMax their points, nobody really loves their credit card company. Apple is a credit card company now. Nobody loves their cable company. Apple is in the business of selling TV shows and acting as a middle man to other TV channels.

This is the part where I exhort Apple to take a stronger hand in opening up the black box of Goldman Sachs’ credit card algorithms and take responsibility for their outputs. But I don’t think it’s realistic to expect Apple to do that.

As it insists on the Apple Card promo page, Apple is not a bank. It just chose to tie its brand to one.

Source: The Verge